As Business Owners of any size-Big, Medium or Small- are you struggling to combat any of these issues day in and day out:

- Insufficient working capital

- Lacking suitable financial literacy

- Indulging in bootstrapping

- Mixing bank accounts

- Ignoring budget

- Inability for statutory compliance

- Excessive debt burden

- Cropping up of unforeseen expenses

- High attrition rate of employees

Then, you desperately need to streamline functioning of Corporate Finance as it seeks to address:

- Funding operations to maximize profits and minimize costs

- Daily cash flow issues

- Accounting work

- Preparation of financial statements

- Taxation

Connotation Of Corporate Finance

Corporate finance is defined as planning, developing and controlling the capital structure of a business.

It aims to increase organizational value and profit through optimal decisions on investments, finances and dividends.

It focusses on capital investments aimed at meeting the funding requirements of a business to attain a favourable capital structure.

Corporate Finance is concerned with raising and administering of funds utilised in business. It entails responsibilities like:

- Maximizing wealth creation while balancing risk and profitability.

- Business expansion through sustainable methods.

Corporate Finance is Subfield of Finance

It mainly:

- Concentrates on the process of how corporations deal with funding sources, capital structuring, and capital projects.

- Addresses investment decisions and accounting.

- Major decision areas include whether or not to pay for investment with equity or debt or both.

Nature and Scope of Corporate Finance

Corporate finance is the process of:

- Dealing with the capital structure of a corporation. If the return on capital exceeds the cost of capital, then the value of the business is raised.

- Maximizing shareholder value through short and long-term financial planning.

- Raising capital through the issuance of stocks and bonds and use this capital to finance investments in new projects.

- Maximizing shareholder value by making decisions that increase the firm’s profitability and investing in projects with a positive net present value.

- Determining the firm’s optimal -mix of debt and equity.

“Corporate Finance encompasses the strategies, tools and structures that enable Corporations to grow from Startups to Large and Powerful Enterprises”

Investopedia

Objectives Of Corporate Finance

1. Long – Term Decisions

Here we include capital investment decisions like:

- Viability assessment of projects.

- Financing through equity and/or debt.

- Pay dividend or reinvest the profit.

Long-term corporate finance decisions related to fixed assets and capital structure and known as Capital Investment Decisions.

Capital Investment Decisions constitute 3 decisions:

- (a) Decision on Investment

- (b) Decision on Financing

- (c) Decision on Dividend

2. Short – Term Decisions

These are concerned with working capital management decisions which try to strike a balance between current assets such as cash, inventories, and current liabilities less than a year.

Functions Of Corporate Finance

Broad Functions of Corporate Finance are:

- (1) Raising of Capital or Financing

- (2) Budgeting of Capital

- (3) Corporate Governance

- (4) Financial management

- (5) Risk Management

1. Acquisition Of Resources

Acquisition of resource indicates fund generation at the lowest possible cost.

Resource generation is possible through:

- (a) Equity: This includes proceeds received from retained earnings, stock selling, and investment returns.

- (b) Liability: This includes warranties of products, bank loans, and payable account.

2. Allocation Of Resources

Allocation of resources involves investment of funds for profit maximization.

Investment can be categorized into 2 groups:

- (a) Fixed Assets – Buildings, Land, Machinery etc.

- (b) Current Assets – cash, receivable accounts, inventory.

Principles Of Corporate Finance

Principles of Corporate Finance are:

- 1. Investment Decision

- 2. Financing Decision

- 3. Dividend Decision

- 4. Liquidity Decision

1. Investment Decision

The firm has limited resources that must be allocated among challenging uses.

On the one hand, the funds may be used to generate added capacity which in turn generates additional revenue and profits.

On the other hand, some investments result in lesser costs.

In financial management, the returns from a proposed investment are compared to a minimum acceptable hurdle rate in order to accept or reject a project.

The hurdle rate is the minimum rate of return below which no investment proposal would be accepted.

2. Financing Decision

Financing Decision imply when, where, from and how to acquire funds to meet the firm’s investment needs.

Some of the widely used instruments for raising funds are ADRs, GDRs, ECB Equity Bonds and Debentures,

The core issue in Financing Decision is to maintain a right mix of debt and equity in the firm’s capital structure.

The change in shareholders’ return caused by change in profit due to use of debt is called the Financial Leverage.

3. Dividend Decision

The share price at a given point of time is the present value of future cash flows associated with the holding of shares. These cash flows are Dividends.

The proportion of profits distributed as dividends is called the dividend payout ratio and the retained proportion of profits is known as the retention ratio.

4. Liquidity Decision

Liquidity decision is concerned with satisfying both long and short-term financial commitments.

The cash inflows and cash outflows should be synchronized. An investment in current assets affects the firm’s profitability and liquidity.

“Beware of little expenses. Small leak will sink a great ship”

– Bengamin Franklin

Vital Role Of Corporate Finance

Managing Risk

The company must involve in certain primary risks like buying some best insurance plans to protect against:

- Plant hit by natural calamity,

- Sudden fall in product sales,

- Mass resignations,

- Death of a crucial employee.

Decision Making

There are several decisions made based on the availability of finance from various sources.

It must give consideration to whether or not it would be financially practical and if it would yield expected profits.

Research & Development

Corporate Finance is important for a business to constantly perform development and research on the market and products.

The business must continue generating changes in their aged goods. as also create new products.

Minimizing Manufacturing Cost

Financing facilitates minimizing manufacturing costs.

In several organizations, finance help to:

- Place a bulk order for raw materials,

- Buy quality products which are on offer at cheapest price.

- Buying software to reduce time-consuming paperwork.

- Buying automated machinery for mass production and more.

Raising Capital

Once an organization has to invest in a brand new venture, it can be achieved by j selling debentures or bonds taking financial loans from the banks and more.

Effective Functioning

Proper financing method and technique will enable businesses towards operating in the right direction.

- Wages to employees would be paid timely.

- Financing installments would be paid on timely basis.

- New / repair for existing plants and machinery.

- Research and development for new/existing products.

- Payments to raw materials suppliers, distributors, advertising, promotional campaigns can be done timely.

Growth And Diversification

Diversification means expansion to make new or existing products.

Crucial importance of Corporate Finance lies in purchase of equipment plus modem technology.

Short-Term And Long-Term Goals

The short-term objectives might include:

- Spending the salaries.

- Managing and controlling short-term assets.

- Acquiring corporate finances just like bank drafts.

- Financing from suppliers.

- Buying raw materials for production.

Long-term objectives will consist of:

- Obtaining bank financial loans.

- Increasing the number of customers.

- Creating long-term assets and more.

Marketing A Company Or Product

Corporate Finance is important for:

- Advertising products and promoting company.

- Articles of Association, Memorandum of Association, Project Report.

- Purchasing assets, plant and machinery, raw materials.

- Paying wages, promotional expenses, other miscellaneous expenses.

Dividend And Interest

The business has to pay dividends and interest.

Corporate Finance Activities

Capital Investments

The capital investment decision process is primarily concerned with capital budgeting.

Through capital budgeting, a company:

- Identifies capital expenditures,

- Estimates future cash flows from proposed capital projects,

- Compares planned investments with potential proceeds,

- Decides which projects to include in its capital budget.

Capital Financing

Corporate Finance also involves sourcing capital in the form of debt or equity.

Capital Financing is involving decisions about the necessary amounts of debt and equity.

Short-Term Liquidity

Corporate Finance is tasked with short-term financial management to ensure that there is enough liquidity to carry out continuing operations. Short-term financial management concerns current assets and current liabilities, or working capital and operating cash flows.

Activities That Govern Corporate Finance

Return Of Capital And Dividends

This requires corporate managers to decide whether:

- To distribute the earnings to shareholders in the form of share buybacks or dividends or to retain the excess earnings for future operational and investment requirements.

- Retained earnings that are not distributed to shareholders should be utilised to fund the expansion of a business.

A company must pursue a capital investment if there are chances of earning a rate of return on it, -higher than the organization’s cost of capital.

Otherwise, it must return the excess capital to shareholders through share buybacks or dividends.

Capital Budgeting And Investments

Capital budgeting and investing include planning regarding where to place the long-term capital assets of an organisation to produce the highest risk-adjusted returns.

Applying financial accounting tools, it is possible to:

- Estimate cash flows from proposed capital projects.

- Compare planned investments with projected income.

- Identify capital expenditures.

- Decide which projects you should include in the capital budget.

Capital Financing

Capital financing includes decisions regarding how to finance capital investments optimally via the business’ debt, equity, or a combination of both.

The key is to balance the two sources (debt and equity).

The capital structure of an organisation is optimized by reducing its WACC (Weighted Average Cost of Capital).

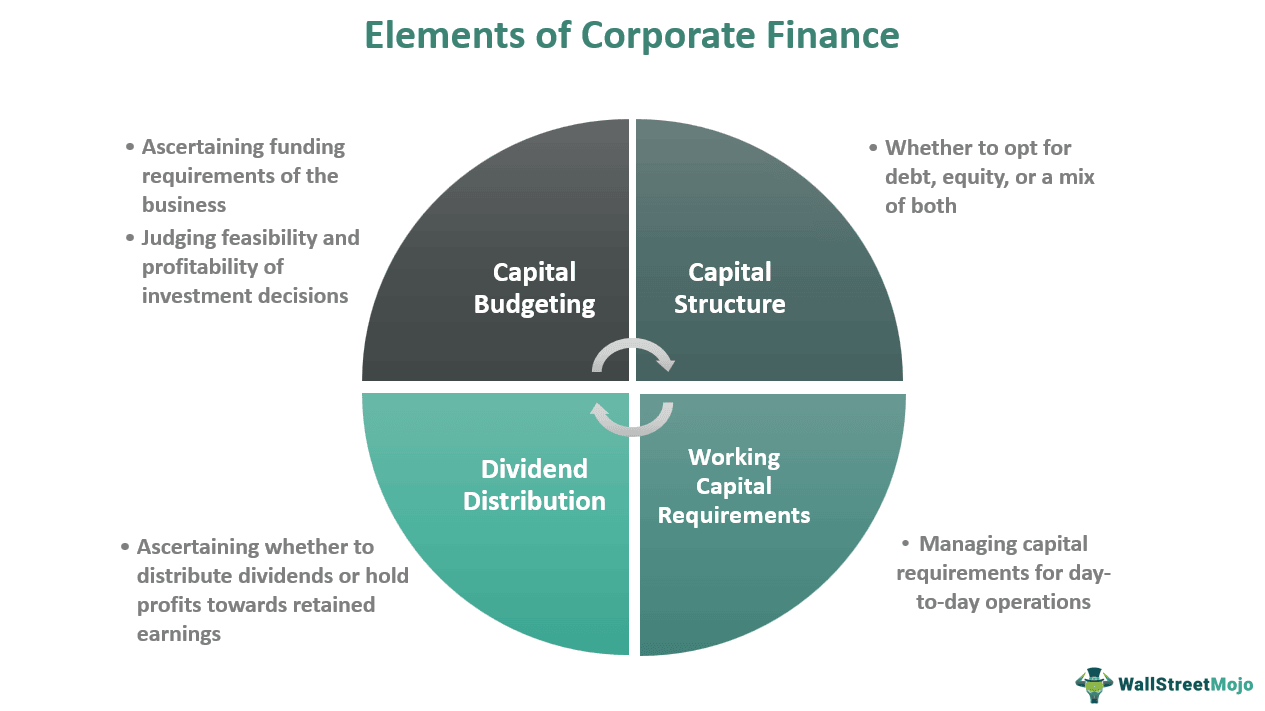

Elements Of Corporate Finance

Capital Budgeting

The capital budgeting process examines the viability of investment proposals and aids investment in profitable projects.

Comparative analysis of present and future investment value is conducted. This enables interpretation of risk-return aspects concerning organizational goals. Ultimately, the most suitable project is zeroed in.

Capital Structure

The capital structure tells us the method of financing used by the entity. The capital structure, , includes equity, retained earnings, and debts. The investors, prefer a well-balanced combination of debt and equity funding.. Consequently, the proper financial decision produces an optimum mix of various types of funding and enhances the company’s value.

Working Capital

Working capital refers to the capital for day-to-day business operations.

Maintaining the liquidity of the business is essential to avert bankruptcy..

Dividend Distribution

If companies reinvest surplus as retained earnings, it must be backed with a strong conviction that the sum will generate business growth. Similarly, a certain amount of dividend distribution is also essential for many companies to serve their shareholders better.

Working Of Corporate Finance

Corporate Finance operates by employing various financial principles and techniques to manage a company’s financial activities. It involves:

- Assessing investment opportunities.

- Estimating their potential returns.

- Conducting financial analysis to guide decision-making.

- Determine the optimal mix of debt and equity financing to fund operations and projects, considering risk, cost of capital, and financial leverage.

- Engage in financial planning, forecasting, and budgeting to ensure effective resource allocation.

- Evaluating and managing financial risks through strategies like hedging and insurance.

Ultimately, the goal of Corporate Finance is to maximize shareholder value by making informed financial decisions that align with the company’s strategic objectives.

Principles Of Corporate Finance

Investment Principle

The firm should invest in those projects that maximise the firm’s value. The investment principle is the guideline that suggests that investors should put their money into projects that are likely to earn a return more significant than the minimum acceptable return.

Financing Principle

The firm should use a combination of debt and equity financing to minimise capital costs. The financing principle is the guideline that suggests that a firm should finance its investments with the cheapest source of funds.

Dividend Principle

The firm should pay shareholders dividends to maximise shareholder value. The dividend principle is the guideline that a firm should pay dividends to shareholders only if the firm has excess cash.

Guiding Parameters For Decision Making

Corporate Finance principles encompass a set of guiding parameters that constitute the basis of financial decision-making within a company. These parameters are:

- Value Maximization

- Time Value of Money

- Risk-Return Trade-off: Cost of Capital

- Capital Structure

- Diversification

- Agency Theory

Types Of Corporate Finance

A Range Of Benefits Of Corporate Finance

1. Efficient Business Operations

Well-planned corporate finance ensures that business’ finances are in top shape and capital allocation is streamlined effectively. It implies:

- Loans are cleared on time,

- Raw materials purchased as required,

- Salaries are paid on time,

- New product launches proceed as planned,

- Marketing efforts for existing and new products, are well-budgeted.

2. Research And Development

Well-planned Corporate Finance would ensure steady financial support for research efforts that ultimately help business success.

3. Expansion Plans On Track

Advance planning in Corporate Finance will ensure availability of steady flow of funds to acquire future-forward technology and equipment for the business.

4. Operation Management

Corporate Finance plays a vital role in the coordination and control of various activities in an enterprise.to ensure sales do not suffer and eventually, affect the profits.

5. Timely Payment Of Statutory Fees & Taxes

Accounting for payment of GST, Income Tax ,ROC charges and so on while planning Corporate Finance facilitates timely payment to Government and its various agencies.

6. Risk Management

Planning Corporate Finance helps to manage such risks as arising out of natural calamity, strikes etc.

7. Streamlined Asset Allocation

Well-planned Corporate finance helps to keep funds handy for the replacement of fixed assets that suffer depreciation or obsolesce over a period of time..

8. Interest And Dividend Payments

Corporate Finance helps companies to pay interest to banks, creditors and dividends to shareholders in a timely and efficient manner.

A majority of the vital business decisions in organisations are determined by considering fund availability. Performing any function independently without finance is challenging in an enterprise.

Through corporate banking, you can opt for loans and other credit-related products. Notably, credit facilities contribute the biggest share of profits.

SMEs And Corporate Finance

SMEs in India play a significant role on business landscape.

By Definition of Government of India:

- A Small Enterprise has investment in plant and machinery not exceeding Rs. 10 crores and accounting for Annual Turnover of less than Rs 25 Crores.

- A Medium Enterprise investment of less than Rs.50 Crores and Annual Turnover not exceeding Rs.250 Crores.

Before seeking Corporate Finance, an SME has to critically examine various options:

- The speed at which the fund is needed

- The minimum amount that needs to be raised

- The rate of interest that various lenders will be charging

- The documentation required by lenders

- The security or mortgage wanted by lenders

In Retrospect

Mastering the principles of Corporate Finance is sine qua non for success of any Business Owner. For business success it helps a lot in :

Optimisation of financial performance.

- Effective management of risk.

- Positioning business on profitable trajectory.

Evidently, by harnessing the power of Corporate Finance, the Business Owners can realize their entrepreneurial dream as envisaged in their original Mission and Vision.

“Corporate Finance, which services the corporations and governments that borrow money, and that are known as “clients” is by comparison a refined and unworldly place. Because they don’t risk money, corporate financiers are considered wimps by traders”

Michel Lewis