Real Estate Investment has long been a favoured avenue for wealth creation and financial stability. However, behind the lure of potential profits lies a myriad of pain points that every investor must navigate.

From market volatility and financing hurdles to property management complexities, we will explore these pain points and also uncover the promising opportunities that can arise from strategic decision-making.

Whether you are a seasoned investor or a newcomer to the real estate world, our insights will help you navigate these treacherous waters and chart a course towards success in the dynamic realm of Real Estate Investment.

Let us embark on this journey together and unlock the secrets to mastering the art of Real Estate Investing!

“A Man Travels The World Over In Search Of What He

– ( George A. Moore.)

Needs And Returns Home To Find It”

As Real Estate investors are you struggling to combat these pains more often than not:

- Market Volatility

- Financing Hurdles

- Property Management Complexities

- Regulatory Compliance

- Risk and Uncertainty

- Property Selection Dilemmas

- Competitive Market

- Economic Factors

- Exit Strategy Conundrum

- Environmental and Legal Concerns

“DON’T WAIT TO BUY REALESTATE. BUY REALESTATE AND WAIT”

Will Rogers

Statistics speak louder than the WORDS

- Real Estate demand in India is expected to increase to 15-18 million ft by 2025.

- Increased urbanization and rising household income have elevated India to the top 10 appreciating markets on an international plane.

- The Government has permitted FDI up to 100% for townships and development projects.

- India has witnessed a surge in Private Investment in the real estate sector.

- An increase of 66% has been committed by the Government of India in the Real Estate sector.

- Private Equity (PE) Investment in the real estate sector in India stood at 3.4 billion in 2022.

Connotation of Real Estate

Real Estate connotes properties that comprise land and its tangible attachments.

The land includes the actual surface of the earth along with permanent natural objects such as water, dirt, or rock and any minerals or particulars under the surface.

Real estate is:

- The land

- The earth beneath it

- The air above it

- It is attachments to it

- It is legal right

In commercial terms,

Real Estate is an instrument of investment.

Real estate includes all homes, buildings, and lands that are utilised for residential, commercial, or industrial reasons.

Real estate includes both naturally occurring and man-made structures that are permanently affixed to or built on land.

Residential, commercial, industrial, raw land and special use are the five main divisions of real estate.

Real Estate Investing in India is reckoned as one of the safest investment alternatives since it is a tangible asset.

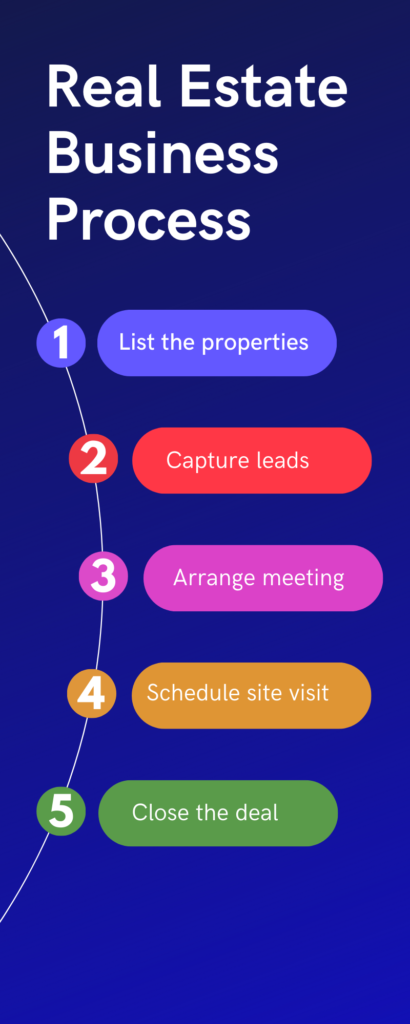

Business Process of Real Estate

Real Estate Industry at Work

The Real Estate industry is a huge factor in economic growth and wealth generation.

Real Estate business entails:

- development

- management

- owning

- selling of assets

The industry starts with raw land.

Land entitlement and developers work to get municipal approvals and construct assets.

The developers may sell the land once it is fully entitled.

By and large, asset managers help fill a property with tenants and get the asset cash flowing. Once properties are stabilized, they can be bought and sold.

An influx of capital may rejuvenate or repurpose property to create more value.

Entities involved in facilitating buying and selling of properties are Brokers, Appraisers, Attorneys, Financiers and so on.

SOLID RATIONALE FOR PROPERTY INVESTMENT

Real Estate as Avenue for Profitable Investment

The real estate business is considered a highly profitable and easy investment option.

An investor can enjoy multiple benefits:

- Appreciation

- Leveraging investment

- Tax benefits

- Regular cash flow

This form of investment is particularly beneficial for those looking for a means of passive income.

Risk Factors in Real Estate Investment

The Real Estate market is prone to crash if several negative factors persist for a long time.

- Risky investment movements

- Flexible interest rates

- Larger mortgage offerings

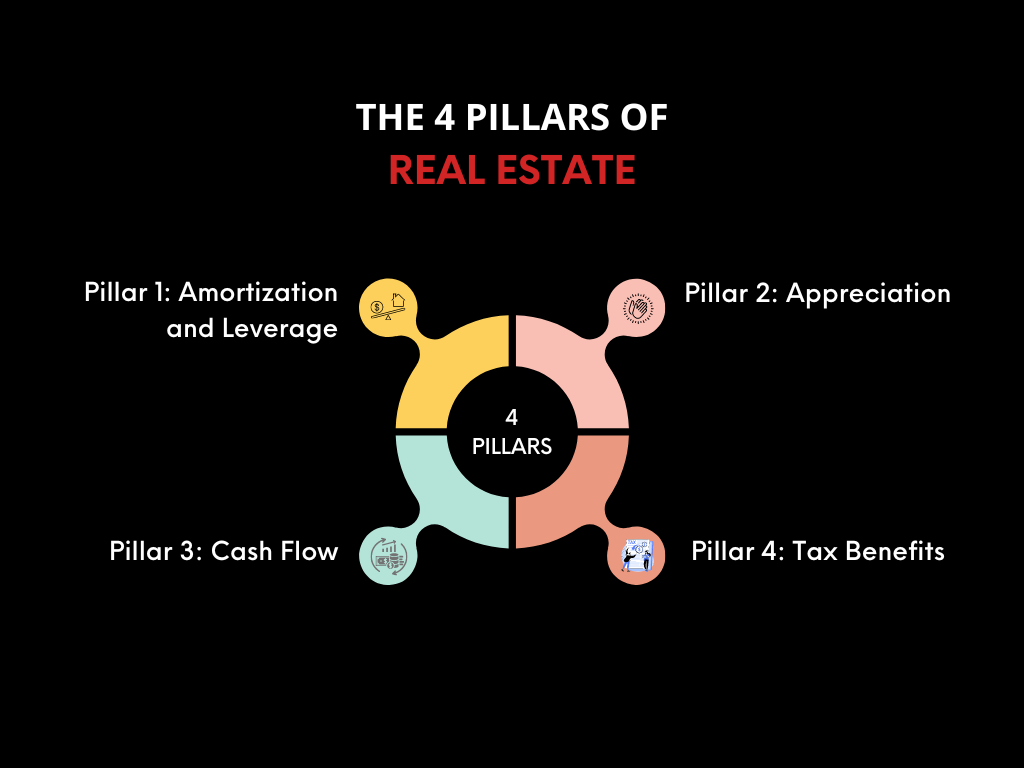

4 Pillars of Real Estate

Pillar 1: Amortization and Leverage

For Real Estate investing, debt serves as a vehicle for building wealth.

Amortization is the process of spreading out the cost of a major purchase, such as property, over time.

The most common method is to make monthly payments on a loan, i.e.: debt.

By adding a loan or mortgage to the deal, Real Estate Investors can use leverage to turn inflation into a higher rate of return on a property.

Using a loan means that investors also risk less of their own cash. Leverage allows them to enhance the property’s rate of return.

Pillar 2: Appreciation

Appreciation is an integral part of the success of Real Estate Investing because investors can either buy or hold the property while it appreciates, or the value can be increased through a number of strategies.

Either way, at the end of it all, the property can be sold for more than it was bought, and investors tent to make a profit.

Buying and holding Real Estate is usually done by renting the property out, to pay for the mortgage while it is owned by the investor.

Actively increasing a property’s value can be done by fixing and flipping houses.

This involves an increase in its value and then selling it again for a profit. Consequently, savvy Real Estate Investors can make a large profit.

Pillar 3: Cash Flow

Cash flow refers to the income and expenses of a property. Owning an investment property involves various operating expenses, such as utilities and mortgage payments, that need to be covered by the income that the property is generating through rent.

Over time, the amount made through income generation of a rental property adds up and begins to create a profit.

If this profit is managed correctly and a positive cash flow is maintained, investors stand to begin generating good returns on their Real Estate Investment.

Pillar 4: Tax Benefits

Tax benefits of Real Estate Investing are:

- Deduction of Depreciation

Depreciation is a non-cash expense that essentially allows investors to claim a deduction for the wear and tear on a property. This can lead to significant tax savings, especially for investors who own multiple properties and are on the hook for property taxes.

- Deduction of Mortgage Interest.

This can make up for any other expenses associated with owning rental property.

Advantage of Capital Gains Tax Rates on Sale

Capital gains taxes are much lower than ordinary income tax rates, resulting in significant savings when the investment property is sold.

Vital Elements for Achieving Success in Real Estate

- To develop a niche and become an expert in that area

This could mean focusing on a particular type of property, such as office buildings or apartments, or becoming familiar with a specific geographical market.

- To build a reliable network

To build a network of reliable partners, such as experienced lenders and contractors. These relationships can provide essential support during the ups and downs of the real estate market.

- Realistic expectations and a long-term vision for your investments

This is to increase the chances of achieving success in the exciting world of real estate investing.

Real Estate Investing is replete with attractive rewards. However, it has its own set of risks and challenges. For achieving success it warrants:

- Due diligence,

- Plan for contingencies,

- Engaging professional advice to navigate these risks and maximize rewards.

This is how you can lay the foundation for a profitable Real Estate Investment venture.

Notable Factors Governing Real Estate Investment

1. Property Location

The adage “location, location, location” is still the king. It enjoys preponderance for profitability in Real Estate Investment. Factors alluring the investors are:

- Proximity to amenities

- Green space

- Scenic views

- Neighborhood’s status

- Proximity to markets

- warehouses

- transport hub

- freeways

Tax-exemption provisions play an important role in commercial property valuations.

A mid-to-long-term view of the area is always taken into account.

With assistance from public zoning and urban planning authorities, it is possible to make the long-term area planning and ascertain how favorable or unfavorable is to your own plan for the property.

2. Valuation of the Property

Property valuation is important for:

- Listing price

- Investment analysis

- Insurance

- Taxation

These factors determine the real estate valuation.

Real Estate Valuation methods include:

- Sales Comparison Approach

Recent comparable sales of properties with similar characteristics — most common and suitable for both new and old properties

- Cost Approach

Cost of the land and construction, minus depreciation — suitable for new construction

- Income Approach

based on expected cash inflows — suitable for rentals.

3. Investment Objectives and Horizon

Considering the low liquidity and high-value investment in real estate, a lack of clarity of purpose may lead to financial distress—especially in the case of mortgages.

It is, therefore, prudent to identify broad categories of property utilization.

- Buy and self-use

- Buy and lease

- Buy and sell (short-term)

- Buy and sell (long-term)

4. Cash Flows Projections and Profit Opportunities

Cash flow refers to how much money is left after expenses. Positive cash flow generates a good rate of return on an investment property.

It is essential to develop projections for the following modes of profit and expenses:

- Expected cash flow from rental income

- The expected increase in intrinsic value is due to long-term price appreciation.

- Benefits of depreciation

- Cost-benefit analysis of renovation before sale to get a better price.

- Cost-benefit analysis of mortgaged loans vs. value appreciation

5. Guard against Leverage

Be alert to avoid over-leverage.

Over-leverage ruins in times of adverse market conditions. Liquidity shortages with high debt obligations can break real estate projects.

It becomes essential to consider the validity of the following points:

- Decide on the suitability of the type of mortgage.

- fixed-rate, adjustable-rate mortgage (ARM), interest-only, zero down payment, etc.

- The risk profile of each type of mortgage must be studied.

- Protect against the terms, conditions, and other charges levied by the mortgage lender.

- Shop around to find lower interest rates and better terms.

6. New Construction vs. Existing Property

New construction usually offers:

- Attractive pricing,

- Option to customize, and

- Modern amenities.

Risks include delays, increased costs, and the unknowns of a newly-developed neighbourhood.

Existing properties offer:

- convenience

- faster access

- established improvements utilities, and landscaping.

Selection of New versus Existing Construction: A Check List

- Review past projects and research the construction company’s reputation for new investments.

- Review property deeds, recent surveys, and appraisal reports for existing properties.

- Consider monthly maintenance costs, outstanding dues, and taxes.

- For investing in leased property, find out if the property is rent-controlled, rent-stabilized, or free-market.

- Is the lease about to expire?

- Are renewal options favorable to the tenant?

- Who owns the furnishings?

- Quality-check items -furniture, fixtures, and equipment to be included in the sale.

7. Options of Indirect Investments in Real Estate

Real Estate Investment Trusts (REITs)

- Real Estate company stocks

- Real Estate sector-focused mutual funds and ETFs

- Mortgage bonds

- Mortgage-backed securities (MBS)

8. Your Credit Score

You can secure better terms with a higher credit score—resulting in substantial savings over time.

Factors helping improvement in credit score:

- Pay bills on time—set up automatic payments or reminders.

- Pay down debt.

- Do not exceed 30% credit utilization.

- Do not close unused credit cards.

- Limit requests for new credit and “hard” inquiries.

- Review your credit report and dispute inaccuracies.

9. Overall Real Estate Market

It always pays to stay up-to-date with trends and statistics for:

- Home prices and home sales

- New Construction

- Property inventory

- Mortgage rates

- Flipping activity

- Foreclosures

Risk Versus Reward in Real Estate Investment

Striking the balance between risk and reward is crucial to success in Real Estate Investment.

Risk #1: Market Fluctuations

Real Estate markets are cyclical. Periods of rapid growth follow slower activity or even declines in property values. It is crucial to understand local market trends and indicators before making an investment decision.

Reward #1: Capital Appreciation

Over the long term, property values have generally increased, despite short-term fluctuations. Investing in areas with strong growth potential can yield significant returns via capital appreciation.

Risk #2: Vacancy Rates

Vacant rental property does not generate income. Nonetheless, you still have to cover costs like mortgage payments, property taxes, and maintenance. Understanding the rental market, setting a competitive rental price, and vetting reliable tenants are critical steps in reducing vacancy risk.

Reward #2: Rental Income

Investment properties can provide a steady stream of income through rent. In many cases, the rental income can cover the costs and even provide a profit each month.

Risk #3: Unexpected Maintenance Costs

As a property owner, you are responsible for maintaining the property. Unexpected repair costs can eat into your returns.

Reward #3: Leverage

One of the advantages of Real Estate Investing is the ability to leverage investment. By taking out a mortgage, you can purchase a property that is worth much more than the cash you have on hand, potentially yielding higher returns.

Risk #4: Market Illiquidity

Unlike stocks or bonds, it is not possible to sell a property instantly if you need to sell quickly, you might have to accept a lower price.

Reward #4: Direct Control over Investment

Unlike many other types of investments, Real Estate is a tangible asset allowing direct control. Improvements can be made to increase its value or change the rental terms to enhance returns.

Navigating the Pains and Challenges in Real Estate Advisory

The Real Estate Advisory landscape is full of opportunities but it is not without its fair share of challenges.

Real Estate Advisors are often confronted with these challenges. They have their professional ways to navigate competently.

1. Economic Fluctuations

Real estate markets are greatly influenced by economic conditions like:

- Changes in interest rates

- Employment trends

- Broader economic growth causes fluctuations in property prices and rental yields.

Navigating these uncertainties requires staying up-to-date with economic trends and having contingency plans in place.

2. Gamut of Regulatory Changes

The Real Estate sector is heavily regulated, with laws governing everything from property transactions to tenant rights. Changes in these laws can significantly impact the real estate market. Staying updated with regulatory changes and understanding their implications is vital.

3. Technological Disruption

Technology is transforming Real Estate Advisory with prop tech innovations offering new ways to buy, sell, and manage properties. Adapting to these changes, from virtual property tours to data analytics tools, is crucial to staying competitive.

4. Client Expectations and Aspirations

Today’s Real Estate clients are more informed and demand a higher level of service. Meeting these expectations and aspirations call for:

- A client-centric approach

- Excellent communication

- In-depth market knowledge

5. Professional Competition

The Real Estate Advisory field is quite competitive. Excelling in this realm requires:

- a unique value proposition

- strong client relationships

- a reputation for delivering results

In Retrospect

Real estate remains an essential aspect of our lives, encompassing not only physical properties but also dreams, aspirations, and financial goals.

The field of Real Estate Advisory faces numerous challenges. Each challenge presents an opportunity to innovate, adapt and strengthen your business. You can navigate these challenges and thrive in today’s dynamic Real Estate landscape by :

- Staying informed

- Leveraging technology

- Focusing on client service

- Differentiating your brand

It is axiomatic that knowledge is your greatest ally. Whether you are looking for:

- Cozy abode to call home.

- Seeking to diversify your investment portfolio.

- Simply exploring the possibilities.

Keep an eye on economic trends, embrace technology’s innovative solutions, and, above all, Consult with Expert who can help you navigate the intricacies of the market.

“THE BEST TIME TO BUY A HOME IS ALWAYS FIVE YEAR AGO”

Ray Brown