CASH IS KING! CASH FLOW is more than anything else! It boils down to creating efficient CASH FLOW MANAGEMENT. This system will ensure your healthy ROI year on year.

As Business Owners, are you encountering these problems with lightning frequency?:

- Confronted with negative cash flow.

- Lacking liquidity to satisfy Vendors, Employees, and Customers.

- Flushed with dead stock.

- Banks refusing to lend on your profile.

- Caught in a debt trap.

- Scared of insolvency sooner than later.

Then, how to salvage the situation?

Power Of Cash

Since Cash is King. Cash Flow rules the crest in the total financial health of the company.

A company can have a huge number of Accounts Receivables. Yet, it can run short of cash to make purchases, pay wages and invest for the future. Unless account receivables are converted into cash promptly, the company can fail and become a victim of bankruptcy.

Paradoxically, such a situation can arise in spite of enjoying a positive net worth.

Cash empowers business owners:

- To hire the best talent for business.

- Strengthens purchasing power for goods and services for business growth.

- To capitalise on emerging business opportunities.

- Cash flow projections steer the company in the desired direction of business growth.

Prepondrance Of Cash Over Turnover Or Profit

It is without an iota of doubt that business turnover matters to Business Owners.

However, by no stretch of the imagination, does turnover reflect the picture of the financial health of the company. What matters more, rather the most is CASH FLOW which remains at the heart of every business operation.

Just allow any imbalance in your cash flow and you had it!

Starting from small businesses to MNCs, Cash Flow Management constitutes the cornerstone of commerce. In other words, liquidity is of paramount importance to meet obligations to the creditors.

“Entrepreneurs believe that profit is what matters in a new enterprise. But Profit is secondary. Cash Flow matters the most”

Peter Drucker

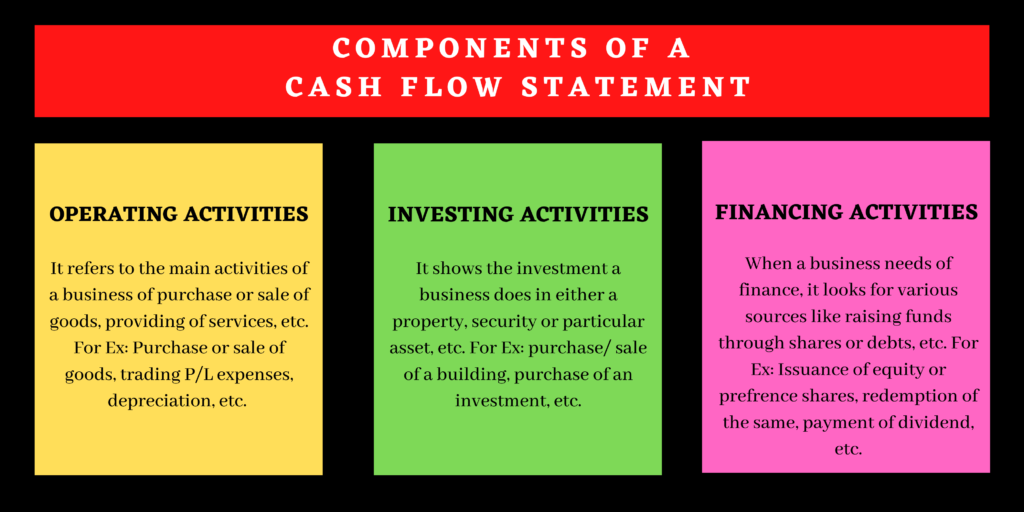

Nature And Scope Of Cash Flow Management

Cash Flow Management connotes the process of monitoring, analyzing, and optimizing the net amount of cash receipts minus cash expenses. It is imperative that the flow of funds is always greater than the outflow of funds. This is the way to generate a surplus. An efficient cash flow management system helps to ensure that surplus funds are invested to reap optimum returns on capital blocked.

Business Owners of any size and dimensions must shorten the cash flow conversion period and strive to bring in money at a faster pace. In other words, they should always maintain a positive cash flow.

Cash Flow Management involves:

- Knowledge regarding when, where and how cash needs arise.

- Knowledge regarding best sources for meeting additional needs.

- Creating good relationship between debtors and creditors.

Cash Flow And Profit Distinguished

Cash flow is concerned with the inflow and outflow of cash. However, profit is the amount left after deducting all the expenses from the revenue generated. This distinction needs to be understood by one and all!

Why Insist On Efficient Cash Flow?

Cash flow management is a measure of the liquid assets of the business. An accurate balance of cash inflow and cash outflow is required all the time. Negative cash flow suggests that the expenses of the company are too high. An efficient cash flow management helps the company to identify unexpected crises looming large.

Objectives Of Cash Flow Management

- To ensure company does not invite cash shortages.

- Avoid long standing debtors on the books.

Benefits Of Cash Flow Management

Solvency and creditworthiness.

Positive cash flow improves credit rating with the banks while lending banks are assured of a safe and secured return of funds deployed by them.

Capex and investment

With a comfortable cash flow position, surplus funds are deployed to reap returns. This helps money making more money.

Boosts Vendor Management

By maintaining a timely balance of receivables and payable, a business is able to honor its vendor commitments in time.

Relationship of trust is built up with vendors.

Consequently, Business Owners are able to negotiate better terms with satisfied vendors.

Boosts Employees’ Morale

Timely disbursement of wages to employees instills motivation and avoids frequent attritions.

In A Nutshell, Cash Flow Management

- Bridges gap between inflows and outflows.

- Helps businesses to control expenses, set target for sales and sales realization.

- Helps effective management of limited cash resources.

- Facilitates planning for timely repayment of debt.

- Timely Investments can be made.

- Facilitates ease of negotiation of financing terms with lenders.

- Helps in business forecasting.

- Helps in short term and long-term cash flow projections.

- Eliminates uncertainties in meeting cash requirements.

How To Analyse Cash Flow

A detailed analysis of cash flow on a weekly, monthly, quarterly basis reveals:

- Cash in hand.

- Total receipts and cash payments.

- Production expenses.

- Amount of cash for goods sold.

Way To Manage Cash Flow

It is essential to prepare a Cash Flow Statement on a weekly, monthly, quarterly and annual basis. In this context, the following steps need to be taken:

- Forecast expenses

- Forecast revenue

- Assimilate data

- Update projection spreadsheet

Cash Flow Projections

Business owners have to assess a number of prior years as a basis of cash flow in the following year. Necessary adjustments are made for anticipated changes like new pricing, recruitment of new personnel, and funding sources.

Actions To Overcome Cash Deficit

- Apply for loan from banks, institutions or individuals.

- Apply for line of credit from banks.

- Speed up collection process.

- Purchase equipment through lease financing or loans.

- Liquidate assets.

- Delay payment to vendors.

Solid Ways To Improve Cash Flow

- Focus on inventory control and get rid of deadstock even at a discount.

- Lease rather than buy to stop blockage of cash.

- Send out invoices on demand.

- Offer discount for early payment.

- Identify alternative streams of revenue to ease pressure on top line.

- Check new suppliers and offer early payment discounts.

- Increase prices in line with competitors.

How To Avert Cash Crunch

The keys factors that help to avoid cash crunch are:

Accounts Receivable

The duration between creating an invoice and keeping the cash to be monitored.

Accounts Payable

The duration between accepting the invoice for purchase is made and payment to be curtailed.

Inventory

The duration between payment for materials and depositing the cash for the sale of items is to be reduced.

Capital Expenditure

Funds to purchase versus recording the cost over the life cycle.

Crucial Role Of Cash Flow Management

- To predict shortfalls.

- To reduce stress by remaining prepared for any contingency.

- To know when to grow with cash on hand and how to earmark for business growth.

Process Of Cash Flow Mangement: Essential Steps

Create a list based on:

- Sales growth estimates.

- Price increases from suppliers.

- Seasonality.

- Wage increases.

- General cost increases.

Jot down anticipated sales income based on:

- Industry trends

- Internal price changes

- Economic factors

List estimated cash inflow like:

- Government grants

- Tax refund

- Loan proceeds

- Royalties

Prepare a list of estimated expenses incorporating surplus payment.

- Wages to staff

- Purchase of assets

- Loan repayments

Consolidate cash inflow and outflow to arrive at net cash flow position.

Way To Maintain Positive Cash Flow

- Maintain some cash reserves to protect yourself from any unforeseen contingencies.

- Track income and expenditure to maximize your business growth.

- Prioritise cash flow for your business as well as for customers.

- Cut your cost by minimizing your outgoings.

- Increase your prices with reasonable doses to survive and grow both in short and long term.

How Crucial Is Cash Flow Management?

- Enables understand spending in better perspective to achieve a healthy ROI.

- Aids Business Owners to maintain credibility and reputation with vendors.

- Improves financial planning.

- Sustains business in the midst of fierce competition.

Startegic Areas In Cash Flow Management

- Give incentives to customers to settle invoices promptly.

- Leverage escrow services to protect cash during high value transactions

- Eliminate wasteful expenditure.

- Explore finance or hire purchase options in large investments to overcome cash squeeze.

- Regular monitoring, reporting and forecasting of cash flow puts businesses on profit and growth trajectory.

What Cash Flow Management Entails

- Constant diligence

- Regular reporting

- A tight grip on expenses

Failing in this vital element can drive the business of any size or dimensions to:

- Insolvency

- Debt trap

- Diminished profit margin

- Liquidation

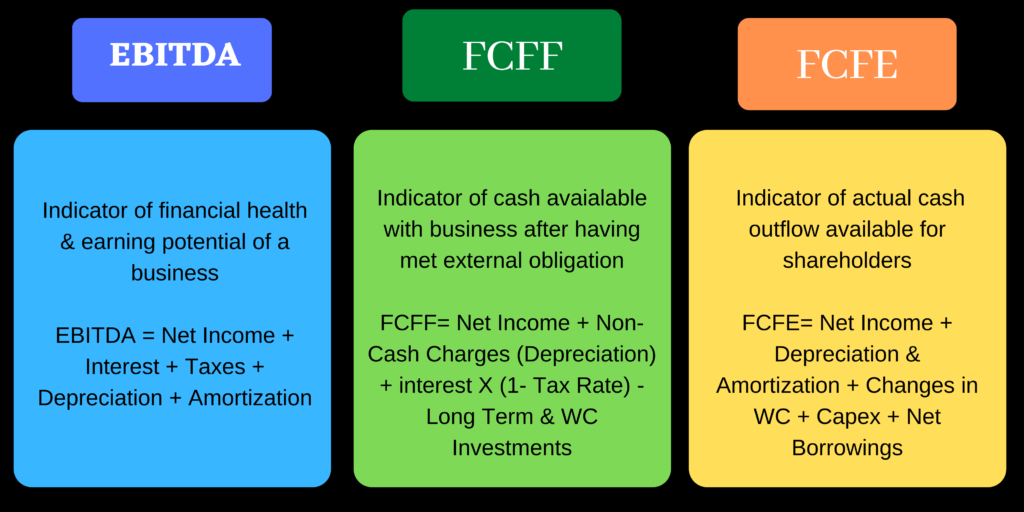

Formulas For Calculating Cash Flow

Business Owners may apply the relevant formula for calculating cash:

Free cash flow

This formula refers to resources available for distribution among the stakeholders.

Free cash flow=Net Income +Depreciation/Amortization-Change in Working Capital-Capital Expenditure

Operating cash flow

This formula indicates the day-to-day cash flow within the business.

Operating Cash Flow=Depreciation+ Operating Income- Taxes+ Change in Working capital.

Cash flow forecast

This formula indicates the cash flow position for a week, month, quarter, or year.

Cash Flow Forecast=Beginning Cash+ Projected Inflow-Projected Outflows=Ending Cash.

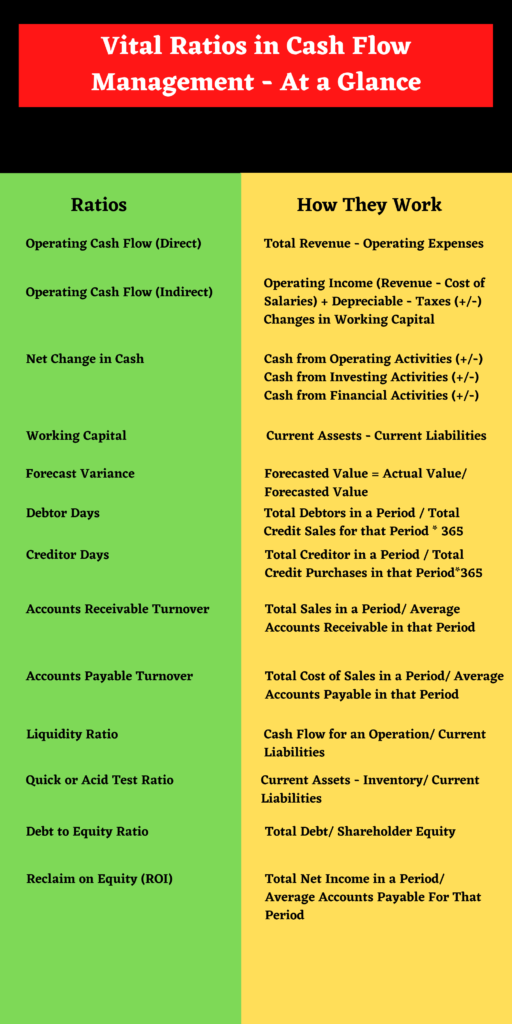

Cash Flow Indicators

Vital Ratios In Cash Flow Management – At A Glance

There is an array of Financial Ratios which need to be borne in mind while calculating your Cash Flow.

To Recapitulate

Never ever take your eyes off the cash flow as it is the lifeblood of your business. A strict vigil over cash flow management yields rich dividends for the business.

It will turn out to be a solid recipe for the financial health of the business.

“The three dreaded words in the English language are NEGATIVE CASH FLOW”

David Tang

ISN’T IT SO ESSENTIAL TO PROPEL YOUR BUSINESS TO THE NEXT LEVEL?