You set out on your entrepreneurial journey with a Mission and Vision.

Your commitment, passion, and perseverance start yielding results.

However, in the mid-stream, you realize that your profits and cash flow have failed to demonstrate the expected trajectory. You are compelled to shift your focus on the analysis of finance and accounts ailments.

Mind you, this is neither your Mission nor Vision.

Thus, starts the whole rigmarole again!

You are seized by the gyrations of

WHAT TO DO AND WHAT NOT TO

Are You Business Owner?

SME – Startup – Corporates Or Corporate Subsidiary?

Struggling With Finance And Accounts Functions?

- Unable to elevate your business to next level?

- Lacking adequate insight into financial complexities?

- Have hit a plateau with hazardous cash-flow management?

- Cannot figure out ways to manage finances?

- Incompetent to afford services of Chief Financial Officer (CFO)?

Enormity Of Such Challenges Are Bound To Cause

Frustration Arising From:

- Loss of business opportunities.

- Lack of adequate control mechanism.

- Unproductive and wasteful processes.

- Faulty transaction from existing to new system.

- Exposure to avoidable legal or tax risks.

External Pressure Stemming From:

- Mounting regulations of finance functions.

- Increasing disclosure levels.

- Peer comparison by regulators.

Internal Pressure Emanating From:

- Budgetary allocations.

- Scarcity of resources and skills.

- Internal coordination issues.

- Lack of technology to scale up.

- Insufficient decision-making support.

Where Lies The Panacea?

It Lies In

A Business Savvy Solution

Hire A Virtual CFO

What Is A Virtual CFO?

A virtual CFO is an operational and financial expert and renders the services as rendered by a Chief Finance Officer (CFO).

Businesses who do not command bandwidth to appoint a CFO owing to paucity of financial resources, which are already overstretched, have no option but to Hire a Virtual CFO.

A person or a team providing Virtual CFO Services are called CFO Service Providers (CSP).

A Virtual CFO steps in to play the all-crucial role of CFO at a fraction of cost. He is not a full-time employee of the company. He works remotely on a contracted basis with a part-time schedule.

Strategic Distinction Between Virtual CFO And Accountants

An Accountant essentially maintains, audits, and inspects the financial records of the company. He specializes in tax matters or confines focus to book-keeping.

In contrast, a Virtual CFO commands vast experience from diverse industries, companies, and professionals. His main focus is on crafting and executing viable finance strategies aimed at:

- Improving Cash Flow.

- Bolstering Revenue and Profit.

- Reducing Tax Liabilities.

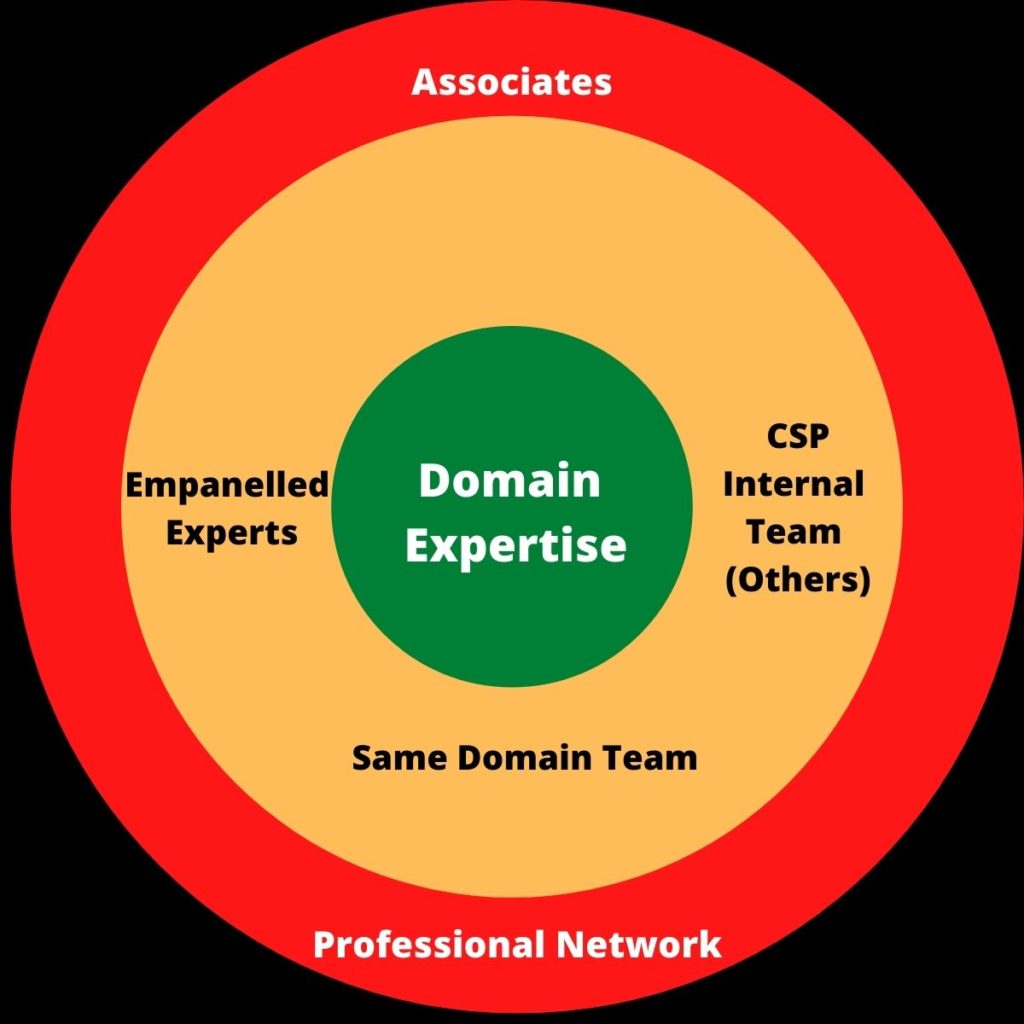

Virtual Eco – System

Essential Parameters of Virtual CFO Ecosystem are:

- Diversified geographies for execution.

- Service one client having multiple business locations.

- Diversified business segments.

- Diversified functional expertise.

- Skill to operate in a larger team.

Professional Profile Of Virtual CFO

- Commands exponentially compounded experience of working in different niches.

- Mastery over finance and accounts.

- Manpower resources.

- IT systems.

- Office infrastructure.

- Communication tools.

Parameters Governing Functioning Of Virtual CFO

- Focus on growth.

- Planning for success.

- Guidance in the decision-making process.

- Manage the scalability of a business.

- Risk mitigation and management.

Operational Areas Of Virtual CFO

Improvement Of Financial Performance

- Comprehensive financial roadmap is prepared covering:

- Annual plan and monthly estimates of sales, gross margin, operating expenses, cash flow, profitability and capital purchases.

- Metrix is laid down to monitor – Key Result Areas (KRAs)

Timely Reporting Of Accurate Financial Data

- Proper control and procedure to book invoices, payables, payroll and manage cash.

- Review financial statements with management on monthly basis.

- Ensuring that financial records withstand a financial audit.

- Satisfying internal customers with financial data.

- Compliance within a regulatory framework.

Strategic Advice

Capitalizing on deep insights gained by Virtual CFOs from experience in diverse industries and other companies, strategic advice of Virtual CFOs can be requisitioned in several areas.

- Advice on personnel and corporate structure.

- Supervise current accounting staff to improve performance.

- Streamline processes for improving financial viability.

- Introduce financial planning and analysis to validate strategic initiatives.

- Attend board meetings with CEO.

- Maintain rapport with external constituents like investors, accountants and auditors.

Circumstances Warranting To Hire Virtual CFO

When

- Business growth process reaches a stage of more complexities.

- Handling potential business risk and ensuring uninterrupted cash flow management.

- Exploiting untapped market opportunities, keeping a strict vigil on potential economic threat become imperative.

- Financials are unfavourable and struggling to maintain profitability to sustain business.

- Lack of clarity in an unprecedented business scenario, sound decision-making assumes paramount importance e.g. situation like CORONA COVID-19.

Grounds To Justify Engagement Of Virtual CFO

Greater Freedom

Virtual CFO helps business owners navigate the journey to aspired objectives without fear or hesitation.

Diverse Professional Experience

Multiple benefits of skills, expertise, and across working knowledge lent by finance professionals.

Continuity

Long-term stability of operating within available resources.

Services are available without any geographical barriers.

Cost-efficiency

Professional resources are at the disposal at affordable cost, particularly for SMEs and Startups.

Credibility

A Third-eye perception of a versatile team of finance professionals without any bias.

Flexibility

Need-based engagement without any apprehension of permanent commitment.

Engagement Model

Virtual CFO operates under 3 Engagement Models

- A separate space is allotted within the client’s office to Virtual CFO and his team.

- For distant geography 3 days, monthly visits are planned.

- Work is planned and executed from CSP’s own office.

- Complaince and procedual assignments are handled online in Virtual enviroment.

- It is a mix of both engagement models i.e On-site and Off-site.

- Execution is done via weekly conference and video calls.

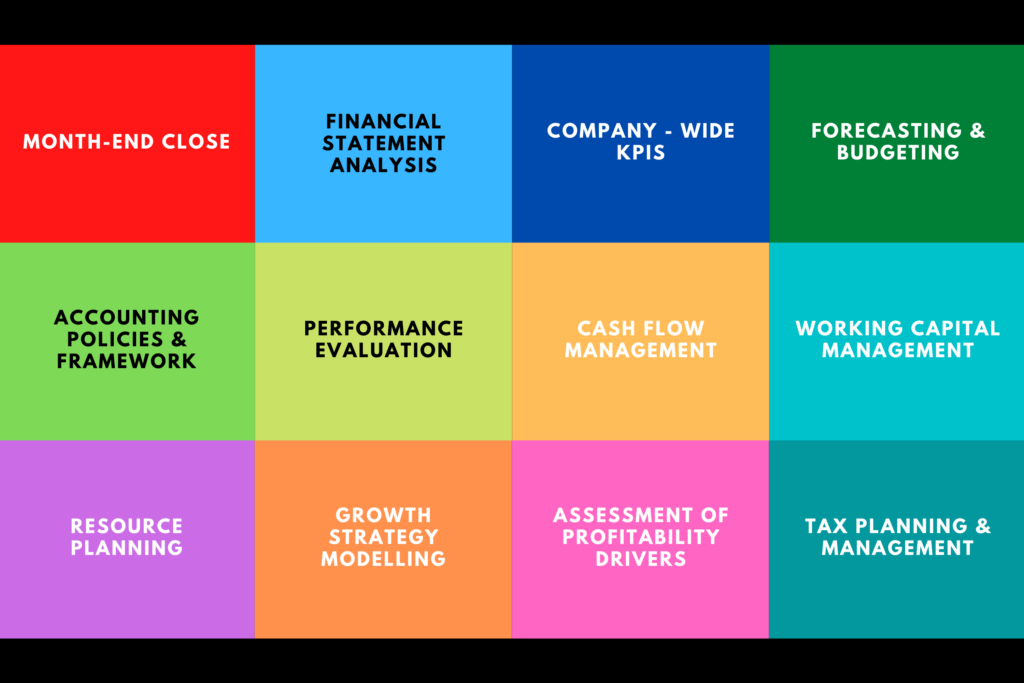

Gamut Of Services Of Virtual CFO

Services During Business Life Cycle

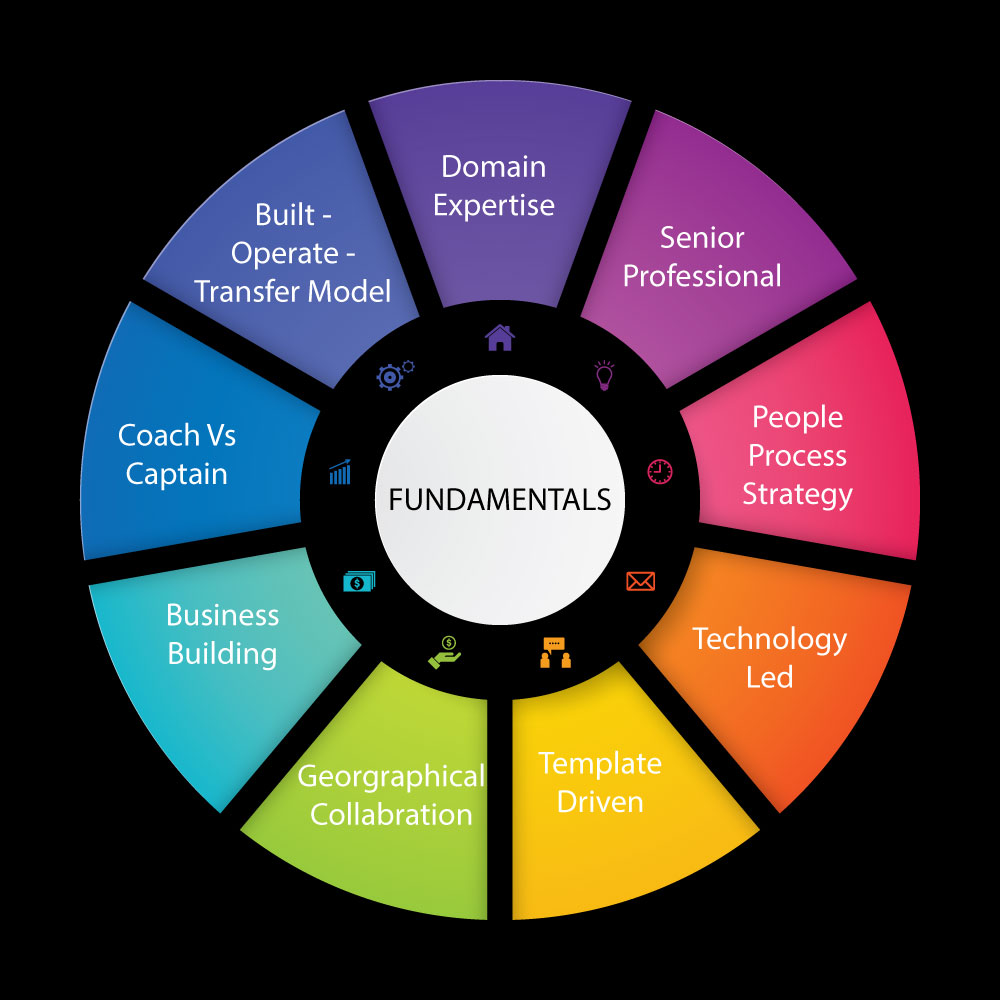

Fundamentals For Efficient Virtual CFO Services

7 Key Result Areas (KRA)

A critical evaluation of services can be attempted keeping in view 7 Key Result Areas within which a Virtual CFO is expected to operate.

- Strategy Formulation Support.

- Policies and Procedure for Implementation.

- Finance and Accounts.

- Transaction Support.

- Commercial and General Support.

- Reporting.

- Exit Strategy.

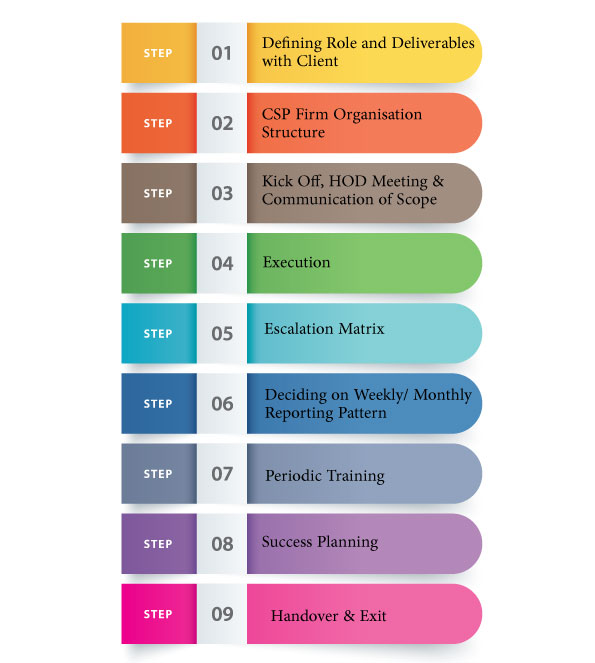

Virtual CFO Execution Process

A 9 – Step Execution Process concerning Virtual CFO in the provision of Services is delineated below.

Ambit Of Virtual CFO Execution Strategy

- Generate Execution.

- Planning with Finance Department.

- Setup Execution.

- Accounts, Tax, Compliance.

- Finance.

- Organogram of Finance and Accounts Department.

- Risk and Governance.

- Commercial Excellence.

- Sales Department.

- Human Resources.

- Training for Morale and Motivation.

- Omnibus Areas.

Reporting System Of Virtual CFO

Vital Role Of Virtual CFO

A Virtual CFO basically directs his efforts in financial operations to accomplish- growth in sales, profit, and cash flow.

Vitality of his role stems from the following tasks performed by him:

Focus on Growth

Delivery of accurate financial information in an efficient way at the right time.

Plan for Success

A Virtual CFO works with a company team to craft a comprehensive roadmap providing Metrix for strict compliance.

Guidance

A Virtual CFO brings with him the knowledge and experience to aid companies in a more informed decision-making process.

Risk Management

A Virtual CFO is competent to manage cash flow leakages and competition threat.

How Does Virtual CFO Scale Up Your Business?

Virtual CFO is apt at:

- Creating financial scenarios.

- Using industry benchmarks.

- Improving revenue models.

Essentially, strategies created by Virtual CFO encompass the following aspects of company finances.

- Strategic planning to increase revenue.

- Managing and improving cashflow management.

- Pricing for profit maximization.

- Financial analysis, budgeting and forecasting.

- Reduction in tax liabilities.

- Accounting health check.

A Virtual CFO Empowers Business Owners By Leveraging Company Data To Arrive At Strategic Growth Decisions

In this context, it is worth noting the following tasks performed by Virtual CFO.

- Oversee and develop the accounting team.

- Budgeting and resource planning

- Accounting policy and preparation of procedures.

- Risk management and internal controls.

- Fundraising.

- Managing relevant technologies.

- Guide CEO in significant financial decisions.

- Regulation and reduction of unproductive expenses.

- Identify Key Result Areas (KRAs).

Significance Of Virtual CFO In SMES & Startups

A Virtual CFO offers tremendous impetus to growth of SMEs and Startups.

- Attracting right talents and retaining it.

- Brings credibility.

- Mentorship to navigate to next level.

- Assurance of capability to sustain performance.

- Identifies various domain functions required by an organization.

- Develops capabilities to meet any organizational challenge.

- Dynamism to influence operational decision-making process.

- Hand-holding to deliver value.

In Retrospect

Virtual CFO enables Business Owners to bridge the gap between where they are and where they aspire to be. He consistently assists in capitalizing on proven financial strategies to eliminate growth barriers. He works in the interest of Business Owners- SMEs – Startups- Corporates or Corporates Subsidiaries. He replaces a Full-time CFO with a hefty compensation package, just at a fraction of the cost.

Perhaps a no better way to create a roadmap to accomplish

Profit Maximization with Cost Minimization.

Indeed, ‘a WIN-WIN situation for all the stakeholders!